State Of Montana Tax Rebate 2025. There is a rebate available for property taxes paid for tax year 2022 and another rebate available for property taxes paid for tax year 2023. 1 to file for rebates of as much as.

At our publication date, no further clarification. This rebate provides a maximum of $675 per year for belongings taxes paid on a number one residence for citizens of montana.

For A $12,166 Solar Panel.

Eligible residents must apply for the 2022 property tax rebate by oct.

The Federal Federal Allowance For Over 65 Years Of Age Married (Separate) Filer In 2025 Is $.

Eligible virginians can look forward to a new.

Montana Homeowners Will Be Eligible For A Second Property Tax Rebate Up To $675 In 2025 For Property Taxes Paid On A Principal Residence For 2023.

Images References :

Source: esicpunjab.org

Source: esicpunjab.org

Montana Property Tax Rebate 2025 Check Eligibility, Amount, The property tax rebate claim period for tax year 2022 has closed. The federal federal allowance for over 65 years of age married (separate) filer in 2025 is $.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Montana Property Tax Rebate 2025 Eligibility Criteria, Benefits, Montana tax rebate july 2025. The federal federal allowance for over 65 years of age married (separate) filer in 2025 is $.

Source: awbi.in

Source: awbi.in

675 Montana Property Tax Rebate 2025 Know Eligibility & Payment Date, House bill 251 would allocate $125 million. What do i have to do to get the property tax rebates?

Source: www.usrebate.com

Source: www.usrebate.com

Unraveling The Montana Tax Rebate 2025 Your Comprehensive Guide, (ap) — montana’s legislature has passed bills totaling over $1 billion in tax relief and rebates for state residents. What the governor called ‘the largest tax cut in montana history’ provides rebates up to $2,250 for montanans who own.

Source: www.zrivo.com

Source: www.zrivo.com

How Long Does It Take To Get A Montana Property Tax Rebate?, You can check the status of your. There is a rebate available for property taxes paid for tax year 2022 and another rebate available for property taxes paid for tax year 2023.

Source: news.yahoo.com

Source: news.yahoo.com

What to know about Montana's new and property tax rebates, The revenue department will start accepting 2025 claims. The federal federal allowance for over 65 years of age married (separate) filer in 2025 is $.

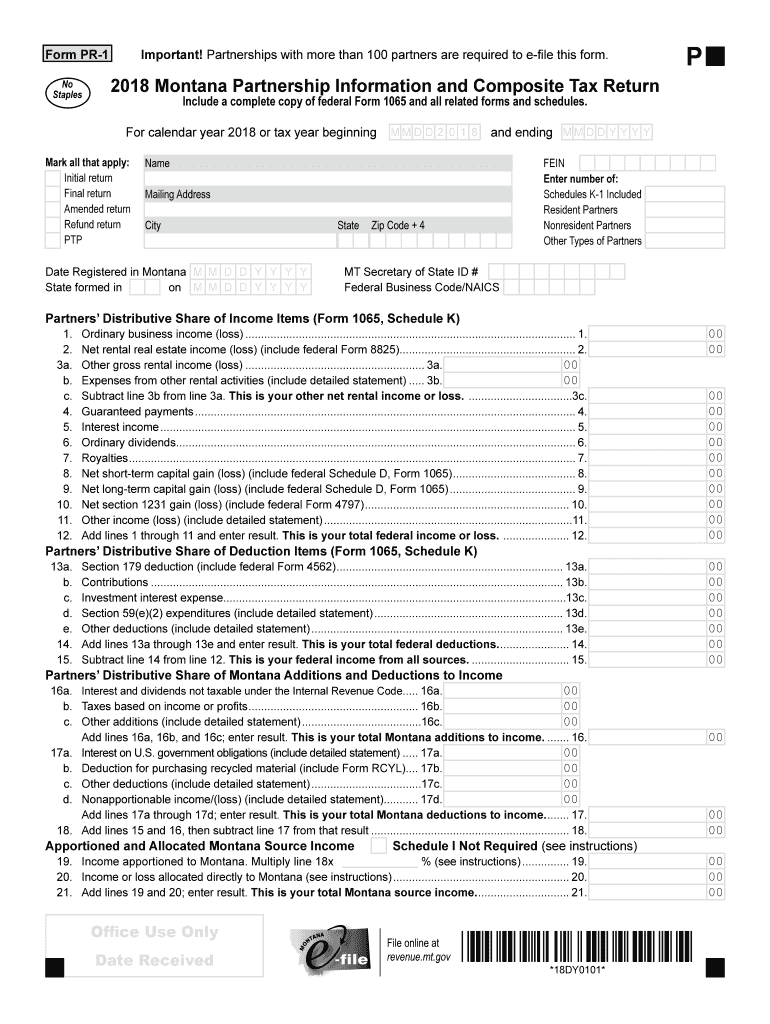

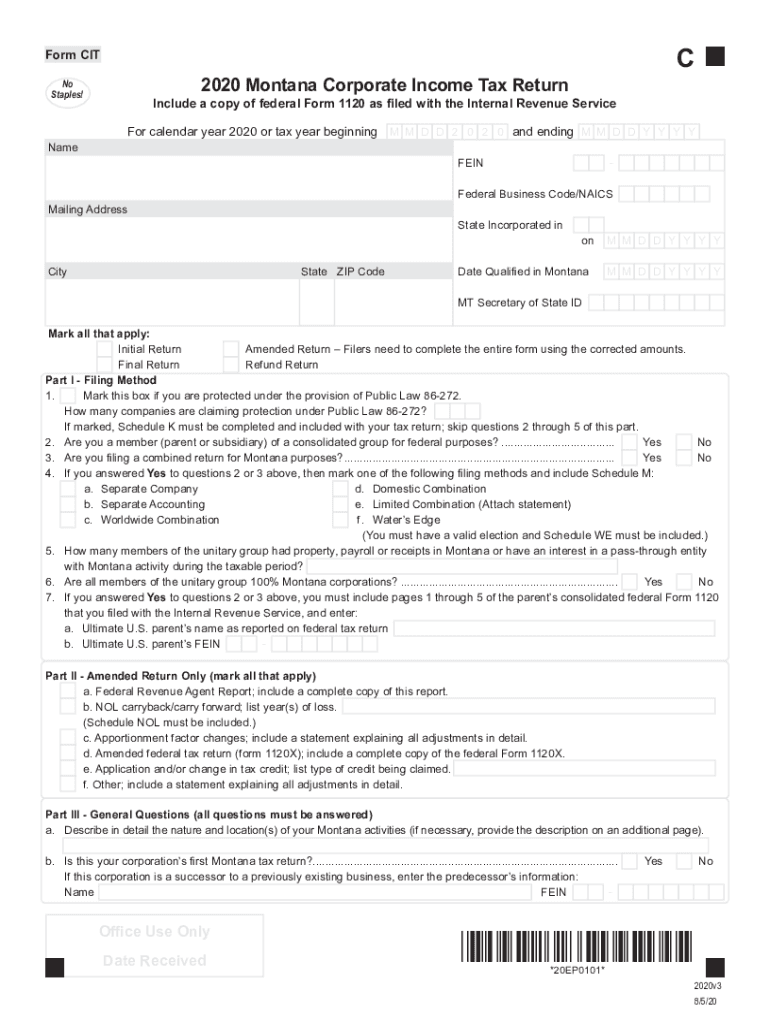

Source: www.dochub.com

Source: www.dochub.com

Montana tax Fill out & sign online DocHub, The eligible beneficiaries can fill out. House bill 251 would allocate $125 million.

Source: fin.ssbjk.org

Source: fin.ssbjk.org

Montana Tax Rebate of 675 for Homeowners Here is How to Claim!, Montana homeowners will be eligible for a second property tax rebate up to $675 in 2025 for property taxes paid on a principal residence for 2023. Eligible virginians can look forward to a new.

Source: casseyqleisha.pages.dev

Source: casseyqleisha.pages.dev

Montana State Rebate 2025 Mandy Henrietta, What do i have to do to get the property tax rebates? To claim the 2023 rebate, residents need to follow the same process.

Source: www.dochub.com

Source: www.dochub.com

Montana tax Fill out & sign online DocHub, The federal federal allowance for over 65 years of age married (separate) filer in 2025 is $. Similarly, massachusetts offers a sales tax exemption for solar panel installations.

The Eligible Beneficiaries Can Fill Out.

Combined, a married couple who owns their home could ultimately receive $3,850 in state rebates this year and next — $2,500 in income tax rebates and two $675.

Eligible Residents Must Apply For The 2022 Property Tax Rebate By Oct.

Eligible virginians can look forward to a new.